Analyzing transactions into debit and credit parts is a fundamental accounting technique that provides a comprehensive understanding of the impact of financial transactions on an organization’s financial position. By delving into the intricacies of debits and credits, this analysis empowers accountants and stakeholders alike to make informed decisions and maintain the integrity of financial records.

This in-depth exploration will delve into the various types of transactions, the concepts of debits and credits, the utilization of T-accounts, the significance of journal entries, and the importance of trial balances in the context of transaction analysis. Through a combination of clear explanations, illustrative examples, and practical applications, we aim to shed light on the complexities of transaction analysis, equipping readers with the knowledge and skills necessary to navigate the financial landscape with confidence.

Analyzing Transactions into Debit and Credit Parts

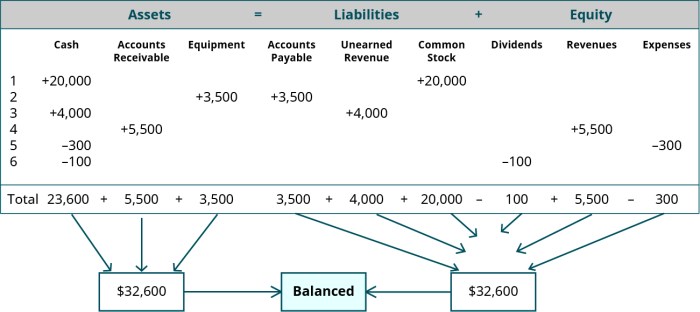

Analyzing transactions into debit and credit parts is a fundamental aspect of accounting. It involves breaking down transactions into their basic components, which allows accountants to understand the impact of each transaction on the accounting equation. This process is essential for maintaining accurate financial records and ensuring the integrity of financial statements.

Transaction Types

- Revenue Transactions:These transactions increase both an asset and equity account. For example, when a company provides services and receives cash, the asset account “Cash” increases and the equity account “Revenue” increases.

- Expense Transactions:These transactions decrease both an asset and equity account. For example, when a company pays rent, the asset account “Cash” decreases and the equity account “Expense” decreases.

- Asset Transfer Transactions:These transactions involve the exchange of assets. For example, when a company purchases equipment with cash, the asset account “Equipment” increases and the asset account “Cash” decreases.

- Liability Transactions:These transactions increase both a liability account and equity account. For example, when a company borrows money from a bank, the liability account “Notes Payable” increases and the equity account “Shareholder’s Equity” increases.

- Equity Transactions:These transactions affect only equity accounts. For example, when a company issues additional shares of stock, the equity account “Shareholder’s Equity” increases.

Understanding the different types of transactions is crucial because it allows accountants to properly record and classify transactions, which ensures the accuracy and reliability of financial statements.

Debits and Credits, Analyzing transactions into debit and credit parts

Debits and credits are the two sides of an accounting entry. Debits are entries made on the left side of an accounting equation, while credits are entries made on the right side.

Debitsincrease asset and expense accounts and decrease liability, equity, and revenue accounts.

Creditsincrease liability, equity, and revenue accounts and decrease asset and expense accounts.

Debits and credits must always balance in order to maintain the accounting equation: Assets = Liabilities + Equity.

Examples of debits and credits include:

- Debit:Cash (asset) when cash is received.

- Credit:Revenue (equity) when services are provided.

- Debit:Rent Expense (expense) when rent is paid.

- Credit:Notes Payable (liability) when a loan is received.

- Debit:Shareholder’s Equity (equity) when additional shares are issued.

Expert Answers: Analyzing Transactions Into Debit And Credit Parts

What is the purpose of analyzing transactions into debit and credit parts?

Analyzing transactions into debit and credit parts helps to maintain the accounting equation (Assets = Liabilities + Equity) by ensuring that every transaction has a corresponding and equal effect on both sides of the equation.

How do debits and credits affect the accounting equation?

Debits increase assets and expenses while decreasing liabilities, equity, and revenue. Conversely, credits decrease assets and expenses while increasing liabilities, equity, and revenue.

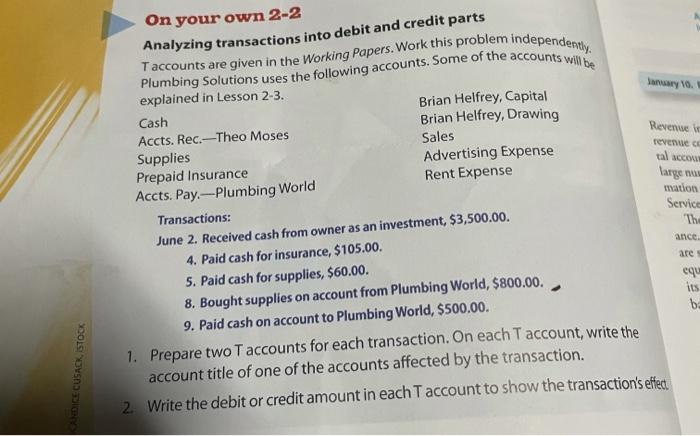

What is the role of T-accounts in transaction analysis?

T-accounts are used to visually represent the changes in account balances resulting from transactions. Each T-account has two sides: the debit side (left) and the credit side (right).

Why are journal entries important in transaction analysis?

Journal entries provide a chronological record of transactions and are used to post transactions to the appropriate T-accounts.

What is the purpose of a trial balance?

A trial balance is a report that lists all accounts and their balances at a specific point in time. It is used to check the accuracy of the accounting records by ensuring that the total debits equal the total credits.